Despite (or maybe, in part, because of) all the disruption throughout last year, OTT streaming services had another landmark year—with more services and more content reaching more people.

But the rapid growth may have obscured some of the more nuanced trends bubbling under the surface. To stay relevant and dynamic in the OTT space, forward-thinking video providers and content owners will need to be able to anticipate the industry’s trajectory.

We’ve compiled some of the most interesting trends, breakthroughs and projections for OTT streaming services—to give you a high-level view of what mattered most in 2020, and where things might be headed in 2021.

Connected growth

It’s no great surprise that, in 2020, audiences spent more time at home. Consequently, the appetite for OTT streaming services naturally spiked—rising from around 45 million US households in March to 69.8 million in April.

And while the recovery timeline for COVID-19 remains unclear, the growth path for OTT streaming services is more certain. By 2024, the OTT video market is expected to surpass $200 billion in subscription fees and advertising revenue.

There are more growth events on the horizon too. Just as lockdown conditions prompted a surge in subscriptions, the increased prominence of new connectivity standards—like 5G and Wi-Fi 6—will improve and increase access to quality streaming services in established markets and developing regions alike.

More interactivity and engagement with OTT 2.0

The future of OTT streaming services isn’t just about raw growth—the experiences themselves are going to evolve.

OTT 2.0 is a new era of streaming services that opens up a two-way flow of content and interactivity between audiences and providers. As competition for viewers intensifies, many providers are already striving to deliver enriched, differentiated experiences that keep more viewers engaged for longer.

We wrote about the additional functionality that launched with Amazon’s Premier League debut as early as February last year. This year also saw Yamaha and SkySports experiment with an app that enabled at-home football audiences to transmit their cheers (and taunts) through their phone and throughout the stadium loudspeakers.

In 2021 and beyond, we expect to see OTT providers ramping up efforts to diversify their service offerings to include additional avenues for real-time audience engagement.

Licensing moves to centre stage

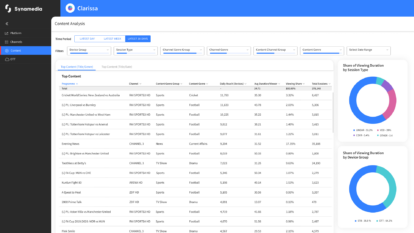

OTT streaming audiences have grown accustomed to a conveyor belt of premium original programming. But last year saw a major disruption to production schedules all over the world, causing many OTT service providers to pad out their libraries with older content. In June 2020, Netflix offered the highest proportion of 10+ year old titles (30%) in five years.

Until production schedules resume, the question remains as to whether a full-price subscription for older content remains a compelling value proposition for audiences—particularly amid potentially challenging economic circumstances.

It’s likely we’ll see an increased focus on licensing to take some of the pressure off. Between 2011 and 2017, telecoms and Pay TV operators struck 332 deals with OTT service partners, in order to vary their content offerings. It’ll be interesting to see how this figure accelerates throughout 2021.

Pay TV and OTT merge

It seems that cord-cutting isn’t as clear cut as previously suspected.

While it’s true that the number of Pay TV subscribers has fallen by approximately 6% since 2019, Pay TV still remains the most profitable market, showing a steady growth in revenue even in light of the skyrocketing of OTT.

Most households also have both Pay TV and OTT subscriptions. In 2019, 45% of US broadband households subscribed to two or more OTT streaming services. By November 2020, that figure had jumped to 61%.

And given that many Pay TV providers have launched their own OTT streaming offerings, pitting the two markets against each other doesn’t reflect the way audiences are consuming both together.

Moving forward, it won’t be a case of these different methodologies of video content delivery trying to outpace the other; Pay TV and OTT services will blend into something new.

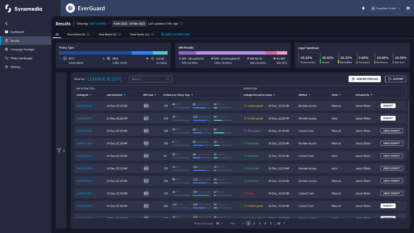

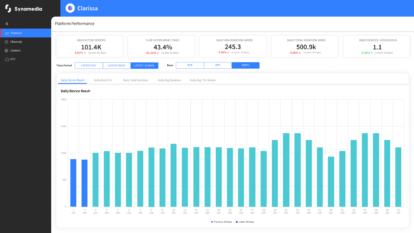

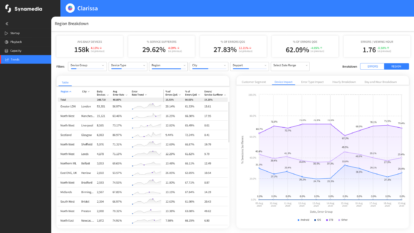

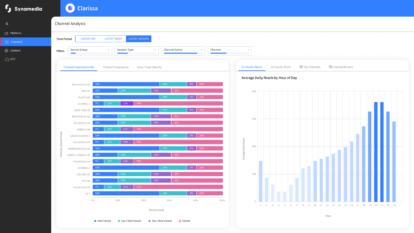

Retention gets scientific

As the market gets crowded and consumer budgets get stretched, subscriber retention is going to be the single most important KPI for OTT streaming services in 2021. Smart OTT providers need to use data insights to understand the true relationship between revenue and churn, and focus their priorities accordingly.

For instance, one 2019 study found that while free trial abuse was a popular concern among revenue-conscious OTT streaming providers, only 5% of US subscribers and 2% of UK subscribers had cancelled within their free trial period four or more times throughout 2020.

Meanwhile involuntary cancellation, which usually occurs when a subscriber can’t pay their bill, was much more prominent. Over 25% of US subscriptions and 33% of UK subscriptions were cancelled due to credit card problems—and around 30% of that group never returned.

OTT streaming providers that invest in a data-driven understanding of retention could see events like involuntary cancellation for the opportunities they are—a chance to compartmentalize the biggest threat to your bottom line into a series of resolvable situations.

Standing at the start of 2021, there’s a huge amount of change behind us and even more on the horizon. It’s going to be a pivotal year for OTT streaming services—there’s more growth potential (and more competition) than ever before.

If you’re running an OTT service, find out how we can help you meet the challenges you’ll face in the coming year by learning how to Regroup, Rethink and Revolutionize your business.

About the Author

Adam Davies is head of Product Marketing at Synamedia. He is a digital content and video specialist, working in media and technology for his entire career, with positions both client and vendor side at organisations including Thomson Reuters, News International and Cisco.

Adam brings new and innovative products to market, having worked with distributed and cloud based solutions for content and media management, and has experience of leading software implementations within Tier 1 Service Providers.