The Media industry: rights owners and broadcasters are fighting a war. It is a war against the illegal theft and piracy of their intellectual property rights, a war that is costing the industry billions of dollars in lost revenue every year. And it’s a war that is impacting the sports media world in particular.

The seminal book on warfare, The Art of War, was written in the 5th century by Sun Tzu, a Chinese General and philosopher. It is still taught today in military academies around the world, influencing generations of politicians, and military commanders. It is also widely used in business leadership training.

Sun Tzu said, “If you know the enemy and know yourself, you need not fear the result of a hundred battles.” Alongside our customers, Synamedia is fighting this war against piracy and, following Sun Tzu’s advice, we want to ‘know the enemy’. One specific part of understanding the enemy is understanding the pirate consumer.

Sports Piracy Report

We published the ‘Charting Global Piracy Report’ earlier this month and followed that up with a webinar discussion (password to stream on-demand: sportspiracy). The report is the first in a series of four, commissioned to discover as much as we could about the motivations of those who consume live sports piracy. The online quantitative study, undertaken by data and analytics firm Ampere Analysis and based on 6,000 sports fans aged 18-64, was carried out in March 2020, before the Covid-19 pandemic stopped play. Consumers were pre-filtered and selected based on their experience of watching sport on TV. The study was run in ten markets: Brazil, Egypt, Germany, India, Italy, Jordan, Malaysia, Saudi Arabia, UK and USA.

There was a pre-conception that most pirate consumers sit outside of the Sports Media value chain: that they steal content, that they do not pay for it and they never will pay for it. We therefore wanted to establish if that was true, because the more we know about the ‘enemy’ the better we can shape responses and services.

What did we discover? That the sports pirate consumer is not the clear cut ‘enemy’ that the industry thought.

Firstly, it becomes clear that the industry is up against a vast problem, with just 16% of those surveyed saying they never watch illegal pirated sport. In other words, 84% of those surveyed are watching sport illegally. Not only that, but they’re paying for it: nearly one third of the most engaged sports pirate consumers are paying for a pirate service.

In fact, a very high percentage, 89% also have a legitimate Pay TV service and 44% a legitimate Sports OTT service. The pirate consumer is not a ‘don’t pay, won’t pay’ criminal: they’re prepared to pay for media and sports media.

Next, we discovered that almost a third of sports pirate service users claim their motivation is due to the lack of a legitimate supplier in their market. Our survey identified three main segments:

- Casual Spectators: at 43% of pirate users, the largest group. Older, most likely to have a non-pay TV service, they don’t pay for a Sports service, but they are very event driven. This group is surprisingly active.

They break down into two sub-categories; one, we call Silver Islanders, they know piracy is wrong, they don’t want to pay or they think don’t watch enough to pay….but still do it… a very hypocritical set. The second category, Ocean Explorers, feel the same, only they see nothing wrong in what they do and think they’re justified in doing it. These Casual Spectators live in the mostly developed markets such as USA, Germany, UK, Italy and the Middle East.

- Loyal Stalwarts: this group, more than a quarter of pirate users, have a Pay TV Sports service, they know what they do is wrong, but they can’t get everything they want on their service.

- Fickle Superfans: 31% of pirate users, these again break down into two categories. Firstly, Internet Buccaneers, younger, cord cutters, cord never connectors, very price conscious, prepared to pay but want everything in one place, they’re social, they share, they use VPNs…but they know it’s wrong and would rather use legal services. Secondly, the Content Plunderers who behave as Internet Buccaneers, but see nothing wrong in what they do.

What motivates sport pirate consumers?

Superfans and Stalwarts clearly pay for sport, but are price, access and service conscious. Their motivation is to get sports content that is not in their legitimate Pay TV package. Alternatively, the content may be unavailable in their territory, or only via a means of consumption that their service provider doesn’t support.

Another driver is ease of access and freedom of access. Superfans and Stalwarts don’t want to be tied down to a contract, they don’t want a Set Top Box (STB). They want to be flexible and mobile.

In that regard, this group behaves as I do personally, but I do so as a legitimate user. I consume sports and entertainment content on Now TV, BT Sport, Netflix, Amazon, Disney Plus, I want ease of access on multiple devices and in multiple homes. Bottom line, I want flexibility and portability for me and my family.

Of course, economics – money plays a part in many decisions: some fans already pay a lot, they don’t see the value, it’s too expensive or they resent paying for it.

Plus, of course, Top Up around big events. Casual fans want to see major events. This might be a Sports TV subscriber who resents paying extra for PPV boxing. Alternatively, it might be a loyal fan who pays for TV, but who cannot access a 3pm Premier League kick off in the UK, for example, because the matches are never shown live. In this case the superfan is denied access: he must attend the game in person or pirate it.

How to stop illegal sport streaming

For the first time, we can see inside the minds of consumers choosing to access illegal streams. With this understanding we can specifically target illegal content consumption to effectively combat live sports streaming piracy.

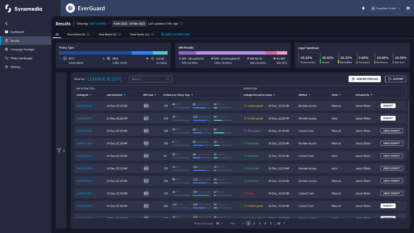

At Synamedia, our mission is to stop illegal piracy. On top of traditional and commonly deployed anti-piracy technologies and operations, we add strategic focus and significant investment in our new unrivalled Proactive Defense service, targeted at commercially driven, illicit IPTV services – services that compete against legitimate broadcasters.

Of course, what we have learnt here paints a much more nuanced picture. Yes, we need to shut down the pirate services, but I believe we have learnt that pirate consumers are not simply driven by economic factors, and the idea that they hold no value in the legal and legitimate Sports Media value chain just doesn’t hold up.

We have identified a very distinct type of consumer who sees what they do as wrong, who does not see value in a full Pay TV Sports service but does want major event-based sport. This gives TV providers an opportunity to cater commercially for the Casual Spectator…not all sports fans are die hard sports fans. For instance, Sky Sports via Now TV offers day passes for major events.

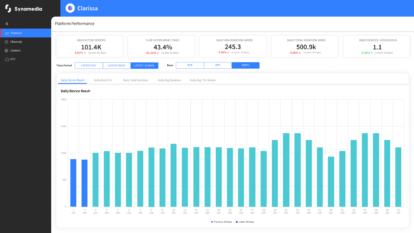

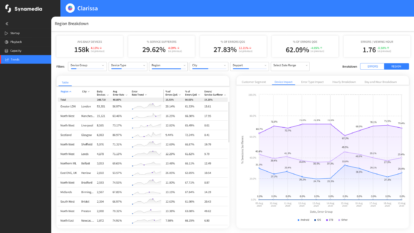

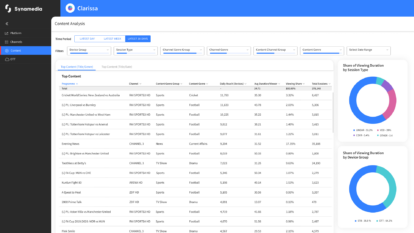

Many of our Security services, such as Credential Sharing & Fraud Insight (CSFI) or Streaming Piracy Disruption are aimed at stopping illegal piracy, but they also have the capability to encourage and drive illegal users to pay for legitimate services. For instance, if a service provider is worried about providing OTT or TV Anywhere access to live sport – the lack of which our survey identified as a key reason for piracy consumption – for fear of widespread credential sharing abuse then our CSFI service will protect them from exactly this.

This granular understanding of sports fans’ attitudes and behaviour enables broadcasters and platform owners to identify opportunities to convert illegal watching into incremental revenue. This can be done with data, commercial models, marketing, education, and of course anti-piracy and revenue protection services.

I will leave the last word to Sun Tzu, “In the midst of chaos, there is also opportunity”.

About the Author

Simon Brydon has worked as a senior executive in the sports industry for 20 years both as a broadcaster and managing and selling media rights, most recently at Pitch International LLP.

From 2008 to 2014, Simon ran the media and digital business of Racing UK where he was responsible for managing and distributing the media rights for the UK’s top 34 racecourses.

In 2003 he created Cycling Television, the live OTT sports TV channel broadcasting the best professional cycling globally. With over 220 days of racing, Cycling TV was a pioneering business and became a world leader in this emerging sector. In 2007 Simon sold the business to a Canadian media company.