2022 came with its share of highs and lows but the wake-up call was served by Netflix in April when it reported a major loss of subscribers for the first time in over a decade. Although we expect significant growth in streaming over the next years, we are entering a period of economic uncertainty with audiences tightening their purses.

“The industry is undergoing so much pressure and change but has responded with indomitable spirit and huge energy around all kinds of new developments focused on enhancing the user experience while generating new revenues for major players, as well as smaller companies and new entrants to the market,” says Nick Thexton of Synamedia on his expectations from 2023.

To understand this further, we asked our experts across the business about their predictions for 2023 and takeaways from 2022. Take a look:

Cautious Optimism

According to Statista, global video streaming revenue was over $80 billion in 2022 and is expected to grow at a rate of over 11% for the next five years. In October, Netflix informed investors that they added 2.4 million new subscribers, surpassing their own expectations. Since November, they have also started rolling out a cheaper ‘Basic with Ads’ plan, with which it plans to regain users. Similarly, data shows that Disney Plus has amassed a total of 235.7 million subscribers across its channels, overtaking Netflix.

So, the indicators for subscriber growth are good, but with some caution as economic and global events appear increasingly dynamic. Innovation will be critical to maintain and grow market share, with new monetisation models, different and more flexible subscriber packages and crack down on password sharing practices in the coming year.

Sport Dominance

Movies, shows and events have been driving streaming businesses, but when there’s a sporting event such as the FIFA World Cup, it walks away with numbers that are unmatchable. For example, the first weeks of the 2022 FIFA World Cup saw a 290% spike in average daily plays, with some streaming services even witnessing a 570% rise on peak days. And in India we’ve seen the digital rights for the lucrative IPL cricket league overtake the broadcast rights for the first time, setting a new ‘streaming first’ precedent.

Given the sheer scale of sports streaming, Apple, Prime Video and Netflix have become vocal about their interest in acquiring these rights, with Reuters reporting Netflix is considering investing in low-profile leagues to dip its toe in the sports streaming segment. But sports rights are one of the most dynamic markets in our industry, and the cautious approach doesn’t always pay dividends, especially when it comes to global players. So, 2023 will see streaming services continue to increase their investment in sports, but the call is to either go big or go home to succeed.

Cost of Password Sharing

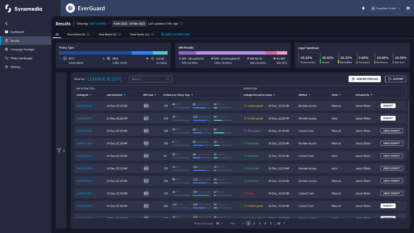

We’ve highlighted for some time the creeping growth of password sharing, but this is now turning from a dripping tap into the Niagara Falls. In 2023, streaming platforms will increasingly crack down on the malpractices of password sharing and piracy that cost billions of dollars in lost revenue.

Although pirated content may look like an alternative for belt tightening consumers, our research into these audiences, conducted by Ampere Analysis, has shown that most of these users already have legitimate pay-TV and sports streaming services they subscribe to. This indicates a potential pool of subscribers who are likely to convert into paying consumers.

Stronger CDN Game

The coming year will also see the scaling of dynamic CDN experiences, something that will be critical to the delivery of live content, including those expensive sports rights. Streamers will need the capacity to support millions of viewers tuning in to a programme at the same time from different locations, devices, and applications, so optimisation of the CDN will be a must-have to keep delivery costs reasonable without impacting quality of experience.

For the consumer, they’ll be seeing high quality content with ultra-low latency and at competitive price, with a dynamic CDN adapting to unpredictable network, infrastructure, audience behaviour and deliver a valuable. Coupling this approach with just-in-time processing will deliver a more efficient delivery capability which will help keep the carbon, as well as the dollar, costs down, which takes us to our next prediction.

How Green is my Stream?

Cutting down on carbon emissions and achieving sustainability are expected to gain prominence, but these may take another 3–5 years to take shape thanks to the lack of workable standards. All stakeholders in the delivery chain will have to be aware of how their actions impact downstream as consumers become aware of the energy as well as the monetary cost to streaming. Better hardware management, and carbon budgeting will become a part of Service Provider requirements, as well the ability to evidence greener initiatives.

Augmenting Reality

We have already seen fans enjoying the FIFA World Cup 2022 with AR adding a new dimension to their viewing experience. From replaying a tackle or a goal during a live match or jumping into the seat next to an F1 racer, augmented experience is set to bring a major shift to live events as we know it.

Sunny, But With Showers

Overall, the industry is eyeing substantial growth over the next few years as the market size is expected to touch $140 billion by 2027. While the United States is expected to be the highest contributor in terms of revenue, China and UK will likely rank among the top five revenue generators. Thus, the industry is set to see a high growth trajectory in the coming years. So, as we say in the UK, it’s a sunny outlook, but with some showers as consumers continue to examine their entertainment spend.

For a detailed look at the top 10 predictions, click here.

About the Author

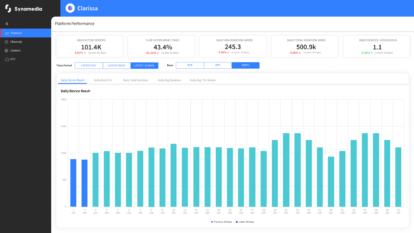

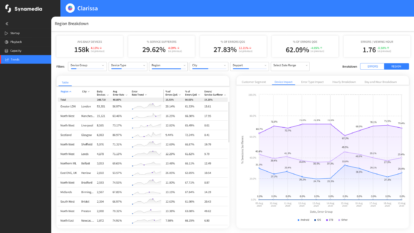

We’re trusted by service providers and content owners to deliver, enrich, and protect video. The flexibility and agility of our cloud and SaaS products enable customers of all types and sizes to launch, monetise, and scale services at speed. Our award-winning portfolio includes advanced advertising, business analytics, broadband and streaming video platforms, anti-piracy solutions, and video network solutions for processing, distribution, and delivery. Synamedia is backed by the Permira funds.

Twitter: @SynamediaVideo

LinkedIn: Synamedia