Operating a multi-screen TV service can be a bit like competing in a triathlon. The best triathletes must master different disciplines, each of which requires different strengths and skills in very different environments. A triathlete could be a world-class runner or a specialist in cycling, but if they can only dog paddle during the swimming leg, they won’t be winning any races.

The TV advertising world is a complex, evolving landscape, where traditional linear broadcast advertising and digital ad solutions are treated as two different businesses, often built for two very different ecosystems using two different technologies. Each of these paradigms offers distinct advantages and disadvantages, influencing how ads are bought, delivered, and measured; however, being successful increasingly requires a multi-discipline approach.

Linear Broadcast Advertising and Its Limitations

In the linear broadcast environment, audience data is gathered through panels like the Broadcasters’ Audience Research Board (BARB) in the UK or Nielsen in the US. These panels collect data from a sample population to estimate television viewing figures. Panel data remains the standard for measuring the success of TV advertising campaigns, with ad planning and operations teams relying on it to calculate ratings and inventory value.

However, a traditional panel-based approach has limitations in the current environment, when there are many more options in what, when, and where to watch TV. Certain audiences may be undercounted, and the data is not provided in real-time, making it less relevant in a digital landscape where decision-making is expected to be more dynamic.

While linear broadcast excels at promoting brand awareness to a large and diverse audience, the absence of detailed data tracking tools makes it difficult to connect advertising efforts to definitive outcomes. As businesses increasingly demand more efficient ways to allocate their advertising budgets, the inability to provide granular data is a challenge, especially when compared to the detailed reporting available in digital advertising.

The Rise of Digital Advertising

The shift towards digital linear programming, delivered via Connected TV (CTV), over-the-top (OTT) or hybrid broadcast broadband TV (HbbTV), has brought with it new opportunities for advertisers to target audiences more effectively. Digital advertising platforms offer greater flexibility in terms of targeting and tracking, allowing advertisers to reach specific audiences based on detailed data points, such as demographics, content preferences, situational use, and contextual information.

One of the major advantages of digital linear advertising is the real-time reporting it offers via an always connected return path. This granular level of data enables advertisers to optimize their campaigns on the fly, adjusting variables like targeting and placement to improve performance. However, digital advertising is still challenged by lower fill rates and a lower average revenue per user (ARPU) compared to traditional linear broadcast advertising.

While linear TV remains essential for total reach and brand building, the high costs and limited inventory available have made it less accessible for smaller brands. In contrast, addressable TV advertising platforms, such as Sky’s AdSmart, have democratized access to TV advertising, with over 60% of AdSmart advertisers being new, non-traditional TV brands.

Audience Fragmentation and the Move to Digital

One of the key drivers for the migration of ad spending from linear to digital is audience fragmentation. As consumers gain more control over what they watch, when they watch, and on which device, the audience is now spread across multiple screens and interfaces. This shift has made digital advertising crucial for generating significant levels of audience reach, which previously might have been achieved through broadcast advertising alone.

The rapid rise of streaming services has also contributed to the shift. As of the end of 2023, 78% of UK households had access to Smart TVs, and 92% of the population could be reached via streaming TV on some type of connected device. However, the proliferation of these services also means that viewing is now fragmented across a much greater number of channels and video on demand services.

Challenges in Unifying Linear and Digital Advertising

Despite the potential benefits of digital advertising, there remains a significant disconnect between linear and digital ecosystems. The two operate with different metrics, technologies, and reporting mechanisms, which creates challenges for advertisers attempting to manage cross-screen campaigns.

The lack of a standardized approach to unifying these two ecosystems means that advertisers often need to rely on multiple third-party resources to balance campaigns across all screens and surfaces. Publishers must also rely on manual processes to bridge the campaign fulfillment divide between platforms. As a result, there is frustration within the industry, and unification of the two ecosystems is becoming an increasingly important topic.

The Promise of “Total TV”

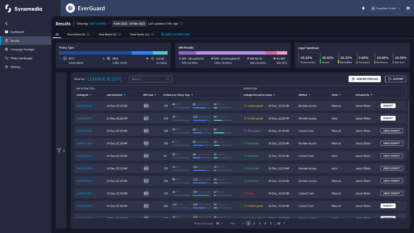

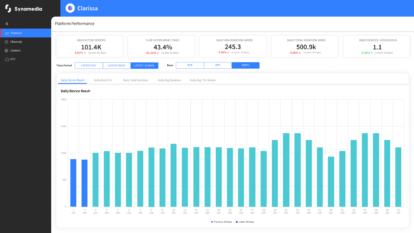

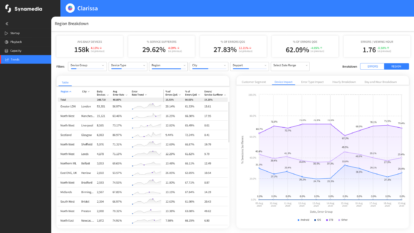

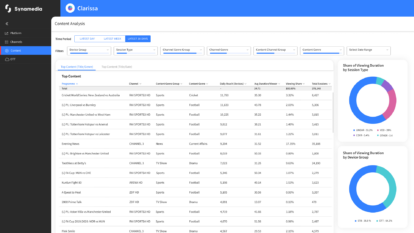

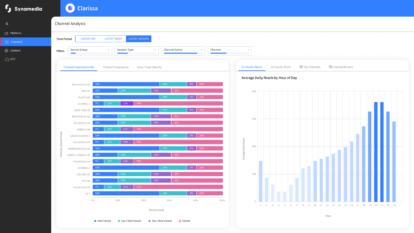

To address these challenges, companies like Synamedia have developed advanced ad tech solutions such as Synamedia Iris, which is designed to unify the two ecosystems into a single, integrated platform. Synamedia Iris can help create a “Total TV” solution that incorporates targeting and measurement data from both broadcast linear and digital TV advertising, resulting in a win, win for advertisers and publishers.

By integrating and normalising data from multiple sources, Synamedia Iris provides a unified view across both linear and digital ecosystems. This approach allows advertisers to consistently buy and execute on both sides without the burden created by different workflows, segment definitions, and targeting options.

Moreover, with flexible inventory management and business-driven prioritization, publishers can optimise campaigns with fluidity between digital and broadcast, regardless of how they were sold or delivered. With unified campaign management, publishers can protect their price points for premium inventory, while increasing fill rates against long-tail content. Additionally, targeted digital campaigns could also be used to complement and extend brand building broadcast activity with more relevant and specific promotions or offers.

Ultimately, when it comes to maximising your profits and improving outcomes for advertisers, a multi-discipline approach is critical to winning the race! If you’d like to find out more about how Synamedia Iris can bring a “Total TV” approach to your advertising business, please contact us.

About the Author

Jeremy leads the global business development function of Synamedia’s addressable advertising product, IRIS. With more than 15 years in media and the digital ad-tech space, Jeremy has experience both on the buy and sell side of the ad-tech industry.

Prior to Synamedia, Jeremy held sales and leadership positions at Whip Media, WideOrbit, Operative, adidas and Experian.