For the last decade, the industry has tried to modernize TV by layering apps on top of legacy assumptions:

- Fixed devices and hardware cycles

- Fixed user interfaces

- Fixed “operator boxes”

- Fixed economics

2026 is where that model finally starts to break at scale.

Not because “cloud” is new. Not because HTML5 is fashionable. But because the web’s operating model is now colliding with TV’s business model—and TV won’t win that collision by doing what it’s always done: more integrations, more middleware, more boxes, more QA, more “one more device”.

Over the next 12 months, we will see a decisive shift from TV as a product to TV as a continuously delivered service—built and iterated like modern web experiences, deployed like cloud software, and distributed like a network function.

If you’re a telco, PayTV, broadcaster, hospitality or media company, the strategic question for 2026 isn’t “Which apps do we add?” It’s: Which parts of our TV stack still deserve to exist as device software?

And here’s the uncomfortable truth: Most “TV platforms” today are still optimized for a world where releases happen quarterly, and devices live for 5–7 years.

In 2026, that’s not just inefficient. It’s strategically dangerous.

Prediction #1: “Device-Centric TV” Hits a Wall

Every operator and broadcaster knows the pain, but few quantify it properly:

- Certification cycles that turn product ideas into 6–12 month timelines

- Fragmented device fleets multiplying QA cost

- Middleware complexity creating integration debt

- Inconsistent performance across chipsets

- Feature innovation constrained by the weakest device in the field

This model can survive when differentiation is content packaging. It cannot survive when differentiation becomes experience velocity.

And velocity is now the primary competitive weapon. The web companies have trained consumers to expect:

- Weekly UI evolution

- Instant bug fixes

- Rapid experimentation

- Personalized journeys

- Features that appear overnight

TV cannot keep answering that expectation with “it’ll be in the next firmware”.

Prediction #2: TV UX Goes Web-Native (Not “Web-Based”)—And That Difference Matters

A lot of the industry still treats the web as a rendering choice: “We can do HTML5.” That’s missing the point.

Web-native means adopting the web’s operating system, which ensures:

- Continuous deployment

- Feature flags and A/B testing

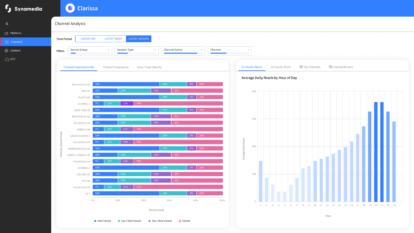

- Telemetry-driven product decisions

- Rapid iteration without device upgrades

- A real-time feedback loop between user behaviour and product evolution

In 2026, the winners won’t be the ones who can run web UI. They’ll be the ones who can operate TV like a living product.

Because the web is not just technology. It’s a methodology for compounding advantage.

Prediction #3: The Cloud Disrupts TV Through Economics First, Not Technology

Most cloud discussions in TV obsess over architecture diagrams. But disruption happens because unit economics shift. In 2026, the cloud’s force is driven by three fundamental collapses: hardware overhead, integration gravity, and the “cost of slow.”

| Feature | Legacy “Box-First” Model | 2026 “Web-Native” Model |

| Release Cycle | Quarterly / Bi-Annually | Daily / Weekly (Continuous) |

| Hardware | High-spec, expensive STBs | Low-cost, cloud-rendered HDMI |

| Security | Hardware-bound secrets; slow to patch | Cloud-based root-of-trust; instant revocation |

| Integration | Heavy Middleware / Chipset SDKs | Standard Web APIs |

| UX Logic | Static / Device-resident | Dynamic / Cloud-orchestrated |

Cloud doesn’t just reduce infrastructure cost; it changes radically what you can afford to try. And experimentation is the real profit engine.

Prediction #4: Personalization Becomes the Default Interface—and the EPG Loses Authority

In 2026, the “home screen” stops being a library and becomes a decision engine.

Viewers no longer want to browse. They want the service to know:

- What mood they’re in

- Who’s watching

- What they will finish vs abandon

- What can be watched in 20 minutes

- What they’ll pay extra for

The EPG was built for scheduling. Modern entertainment is built for flexible intent.

As a result, product teams will shift from “content rows” to journeys:

- Onboarding journeys

- Re-engagement journeys

- Sports journeys

- Family journeys

- Premium upsell journeys

If your platform cannot ship and tune these journeys continuously, you’re not competing with streaming services—you’re competing with the past.

Prediction #5: From “Super-Aggregation” to “Experiences Aggregation”

For years, we’ve heard about the supremacy of the super-aggregator. In 2026, aggregation without experience control becomes a commodity.

That direction was right—but the model is now splitting into two distinct models:

Model A: The Catalogue Aggregator

A unified discovery layer across services. Useful, but replicable. Differentiation is shallow.

Model B: The Experience Aggregator

A service that unifies identity, payments, entitlements, personalization, session continuity, recommendations, and customer care—across devices and contexts.

This model transcends the screens barriers, allowing a full continuum of experiences, like picking up a live sports stream on a hotel TV exactly where you left it on your mobile at the airport.

It also makes it possible to unify all forms of content consumption — across formats and genres (live, sports, news, long-form, short-form, paid, free, live, and social) — under a single, cohesive umbrella.

In doing so, it brings together all generations — from Gen Z to older audiences — uniting even the most niche segments within a simple model that adapts to each user through ultra-personalized experiences.

Model B is much harder. It’s also where the durable value lives.

So Where Does the Market Go Next?

The market direction is clear:

- From devices to services

- From releases to continuous delivery

- From static UX to adaptive journeys

- From platform ownership to experience ownership

- From “TV tech stacks” to web/cloud operating models

This is not incremental evolution. It’s a change in the rules of competition.

If your strategy is still built around device roadmaps, you’re optimizing the wrong constraint.

The Synamedia Senza View: Cloud + Web is Not a Feature. It’s a New TV Operating Model

With Synamedia Senza lens, the 2026 disruption is straightforward:

- Cloud gives TV elasticity, observability, and speed.

- Web gives TV a universal delivery and iteration model.

- Together, they let you build TV experiences the same way the best digital products are built: continuously, intelligently, and at scale.

The traditional TV stack is built to protect stability. The 2026 stack is built to compound learning. And in a market where attention is the real currency, the ability to learn faster than competitors is the ultimate moat.

Is your TV stack ready for the velocity of 2026? Join the shift toward a web-native future. Learn how our cloud-rendered UI platform can reduce your costs and accelerate your innovation.

About the Author

Lionel brings over 20 years of leadership experience across telecoms, media, and technology, with a strong track record in international growth, strategic partnerships, and complex B2B sales. As Sales Director for Synamedia Senza, he leads global growth initiatives, empowering a high-performing sales team to expand the company’s presence, accelerate Synamedia Senza adoption, and help shape the future of TV and entertainment distribution and monetisation.